The lending business is the backbone of most of the projects in the economy. From lending to acquaintances in distress to now a full-blown industry, this practice has witnessed a significant evolution. Despite being a lucrative practice, this industry does not fail to witness multiple scams and deliberate defaults. Such defaults only make lenders wary. […]

Is Bank Statement Analysis (BSA) the Best Tool to Identify Customer Behaviour?

Bank Statement Analysis plays a crucial role in loan sanctioning. It is one of the practical ways to study the financial behaviour of the loan applicant. It gives a comprehensive picture of the customer’s economic history consisting of available balance, deposits, withdrawals, interest, service charges, penalties, overdrafts, and so on needed to vet the creditworthiness […]

Business Intelligence in Banking Industry: Why Are Banks Banking on BI?

Banks have a plethora of data waiting to be organised. We might think since the banks have so much data, they are ready to use Business Intelligence to make the best of it, but it is just the tip of the iceberg. The problem with the available data is that there is only a large […]

Precisa Introduces Smarter Bank Data Retrieval for Fast and Reliable Bank Statement Research

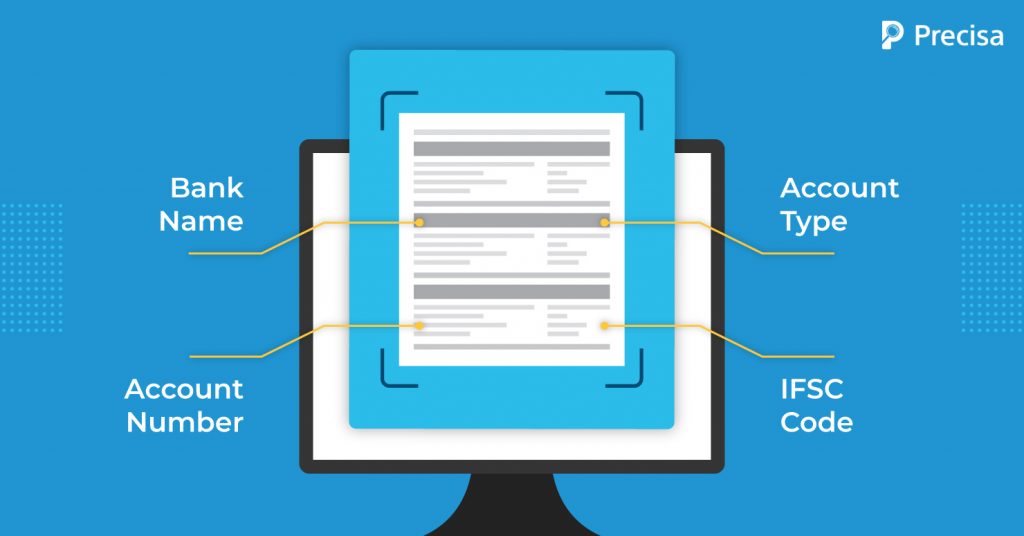

Precisa’s automated bank statement analyser can quickly parse through data, extract vital information, analyse transactions, and aid decision-making. Through its AI-powered engine, Precisa aims to accelerate bank statement analysis with intelligent document processing and data extraction capabilities. In conjunction with a load of powerful features that scrutinise transactions and present actionable insights to lenders, Precisa […]

Role of Customer Due Diligence in Lending

Lending is a risky affair. It always poses the threat that what if the lent money or the item(s) are not returned. It sure requires a lot of trust on the part of the lender but trusting an unknown individual or business entity can misfire and lead to grave troubles. In financial lending, banks and […]

5 Top Reasons Why Bank Statement Analysis Is Crucial for Loan Assessment

After the second wave of coronavirus, economic growth has stalled all over the nation. As the markets are opening up once more, there are hopes for a fresh start, but everyone is even more cautious this time, especially in the lending sector. In such a case, how can formal credit markets extend credit to borrowers […]

Scanned Bank Account Parsing for Easier Research

Precisa is an automated bank statement analysis platform that provides real-time bank statement analytical capabilities and reduces the need for manual intervention. Along with a host of beneficial features to make the evaluation process easy, Precisa has now integrated Scanned Document Parsing. With this new feature, lending institutions can conveniently upload bank statements in a […]

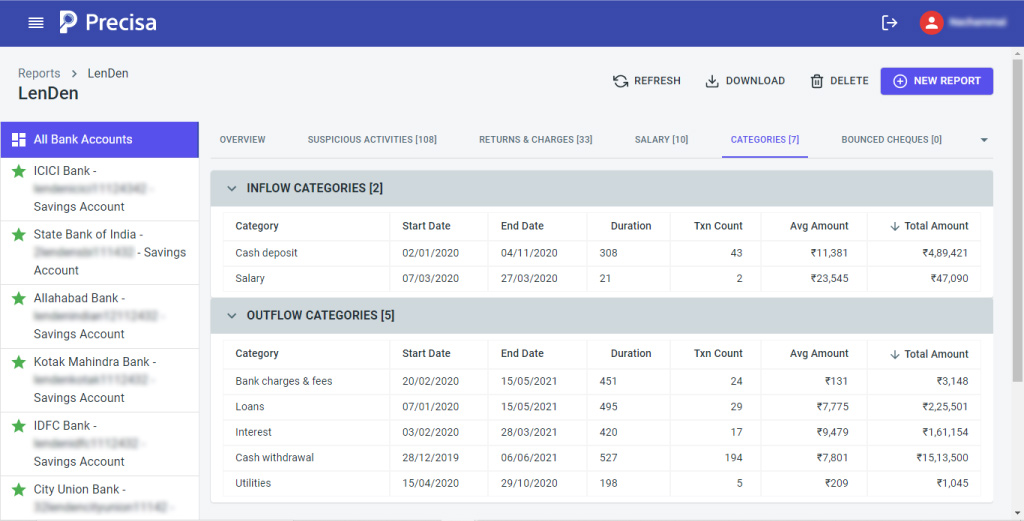

Precisa’s New Category Tab Simplifies Account Inflow and OutFlow Analysis.

Bank transactions can reveal a customer’s preferences, spending patterns, and risk factors if you can create structured features from their unstructured text. Precisa automatically detects the context or purpose of transactions in the bank statement based on its description. For example, if the transaction is ECS/BAJAJ FINANCE LI/7UPBFR809765435 Precisa will automatically detect that this payment […]

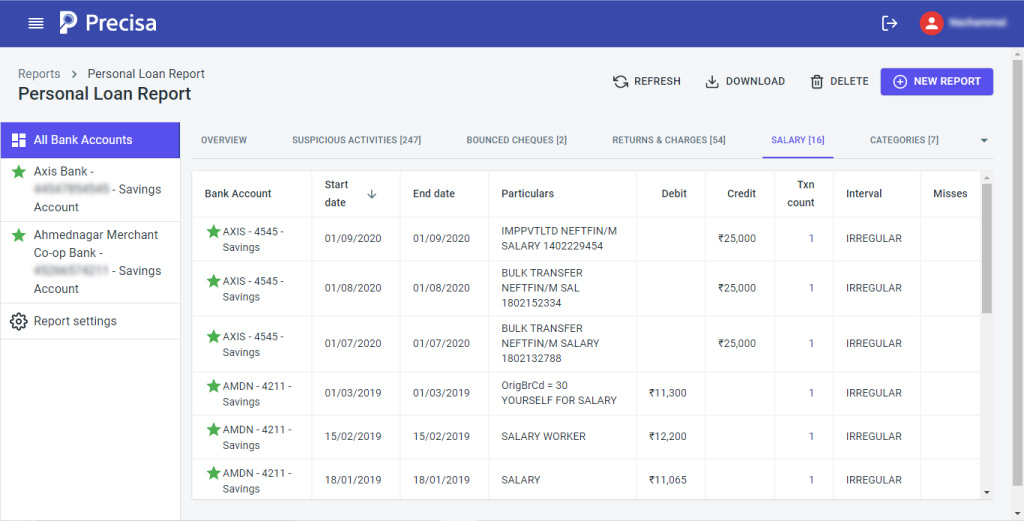

Introducing Precisa’s Salary Tab for Personal Loans Credit Evaluation

A personal loan is often a go-to resolution for individuals to meet any shortfall in financial expenses, including buying a house, vehicle, children’s education, or even in case of medical contingencies, among other things. According to reports, the amount of money borrowed in the form of personal loans has increased sharply, even in the wake […]

Level Up Your Credit Appraisal Process With Precisa’s Bank Statement Analyser

The increasing number of Non-Performing Assets (NPAs) and fraudulent activities in banks and NBFCs today call for severe scrutiny of credit sanctions. This requires a strict evaluation of the applicant’s financial health to understand their position to service the debt. It involves assessing the loan applicant’s creditworthiness based on specific norms, standard procedures, and various […]