Credit decision-making involves assessing a borrower’s repayment capacity and creditworthiness before approving a loan. It is a critical function for lenders as it helps them decide whether to extend credit to an applicant or not and helps them minimise their risk. However, businesses often face challenges in credit decision-making owing to its complexity, which involves […]

Why Banks Should Apply AI-driven Customer Due Diligence

The banking industry has undergone an extensive transformation over the last few years. Rapid digitisation of banking processes and financial ecosystems is reshaping business. Many banks are reducing the number of physical branches while enabling consumers to open accounts online and carry on their transactions in no time. On the flip side of this heartwarming […]

Balance Sheet Analysis for Credit Appraisal: Common Challenges and Solutions

Credit appraisal is a crucial process which lenders use to make informed decisions while lending and stay away from defaults and other risks. It involves thoroughly examining the applicant’s total income, debt levels, assets and credit history. Balance sheet analysis for credit appraisal, which incorporates evaluating a borrower’s financial statements, is integral to the credit […]

What is the Decisioning Stage in Loan Processing?

Have you ever wondered what happens when you apply for a loan? A complex decision-making process is set in motion. At present, this decisioning stage in loan processing stands at the crossroads of a transformation, wielding the power to shape the destinies of individuals and businesses alike. By eliminating some of the more time-consuming procedures […]

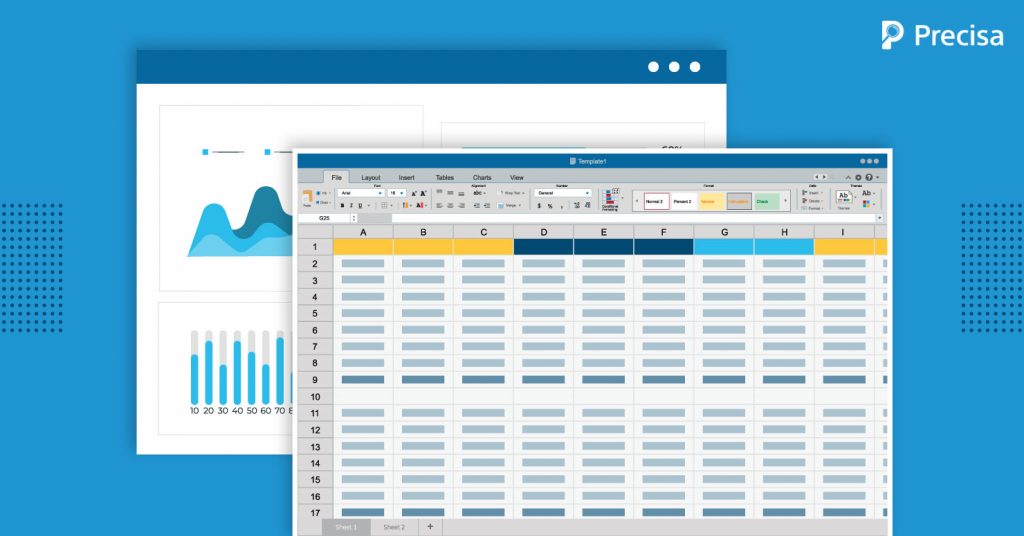

Understanding Bank Financial Statement Analysis: Excel’s Role and Limitations

Despite the arrival of cutting-edge technologies, including artificial intelligence (AI), robotic process automation (RPA), and big analytics, Microsoft Excel still commands a firm grip over financial companies. Even today, analysts at Wall Street continue to rely on Excel sheets primarily due to their reliability, long history of use, and, sometimes, the sheer aversion to switching […]

From Traditional to Trendsetting: Why Lending Fintechs are the New Face of Borrowing

Borrowing is evolving as fintechs in India usher in a new era, shifting away from traditional banking methods. The digital lending market, valued at $43.16 billion in 2018, is projected to skyrocket to $567.3 billion by 2026, boasting a remarkable CAGR of 26.6%. Interestingly, lending fintechs companies are at the forefront of this change, reshaping […]

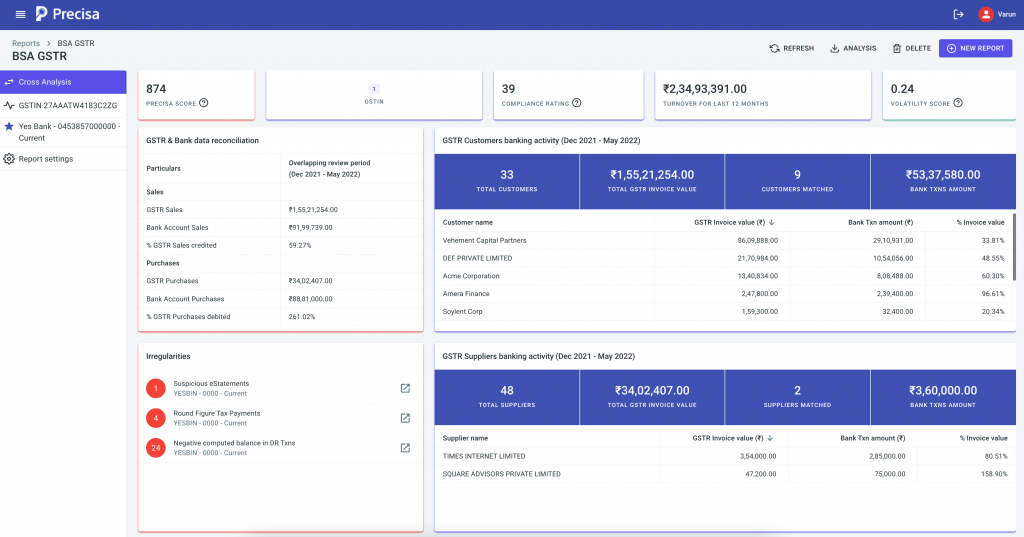

How APIs for GSTR Analysis Help Assess Credit Risk

A mere decade ago, instantly delving into a borrower’s financial history would have been considered sorcery. Today, however, APIs for GSTR analysis make this a daily reality. The APIs (Application Programming Interface) effectively ensure tracking of GST compliance, pinpoint errors, and auto-generate essential reports. Imagine a cutting-edge tool that not only facilitates error detection in […]

Benefits of Leveraging Cross-analysis Tools for Profitable Cash Flow Lending

A healthy cash flow is the signifier of a thriving business. This financial status is especially beneficial for borrowers who do not own assets, which they can offer as collateral to lenders. Access to cash flow lending is enabling more underserved borrowers to get credit on the basis of business performance. For lenders, however, authenticating […]

Calculating DPD in Finance: Guide to Analysing Delinquency

As India’s lending ecosystem becomes increasingly digital and data-driven, monitoring borrower behaviour has never been more critical. With the Reserve Bank of India reporting a moderation in retail credit growth to 16.6% in June 2024—down from 21.3% the previous year—banks and NBFCs are placing greater emphasis on early risk detection and delinquency tracking to protect […]

How AI-Driven Financial Analysis Powering Efficient Due Diligence for VCs and Investors

There is a growing trend of some players in the startup world using misrepresented financials to attract an injection of capital into their ventures. For instance, a recently acquired promising startup was in the news when the acquirer discovered that the business’s financials did not tally up. The acquirer business, despite all efforts, landed in […]