The 2020 pandemic sabotaged the customer relations and trust banks had built over the years. According to a new Accenture analysis, during the COVID-19 pandemic, replacing in-person branch contacts with impersonal digital transactions via online and mobile channels has accelerated the ongoing decline of consumer trust in banks. Hence, banks need to focus on winning […]

8 Digital Lending Use Cases in India

Digital lending in India is undergoing intense activity given the massive opportunity the sector presents. According to BCG estimates, total digital retail loans could cross the $1 trillion mark in the country by 2023. With that as the backdrop, let’s look at the use cases that drive this juggernaut. Digital Lending Models Available in India […]

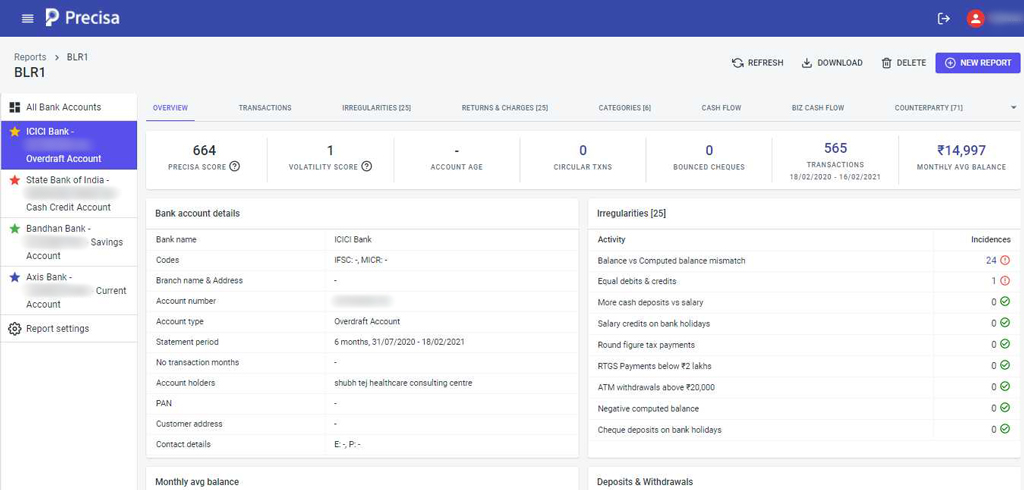

Precisa’s Custom Bank Account Analyzer for Gromor’s Credit Assessment

Gromor Finance is a lending company that provides secured and unsecured financing to unassisted enterprising entrepreneurs of India, who are otherwise excluded from the lending landscape. Through simple lending processes, Gromor aims to give them the right impetus to move forward. Now, being in the lending business, Gromor’s operations rely on analysis of bank statements […]

Account Aggregators Go Live: What It Means & the Way Ahead

Account Aggregator Framework, launched in Sept. 2021 at a virtual event, is a novel technology architecture and part of India Stack – a collection of open-source APIs by GOI. Account Aggregator (AA) is a framework that provides an overview of all your financial data like income tax returns, monthly salary, accounts statements, and other information […]

Decoding the Emerging Trends in Loan Products

The financial lending industry has witnessed aggressive disruptions in recent times owing to the pandemic. Other than the increased need for end-to-end digitisation, plenty of other essential lending trends surfaced in 2020 to date. Consumer lending overall noticed a tremendous spur as people tried to keep up with the effects of the pandemic. With job […]

Automated Bank Account Details Extraction from Bank Statement

Precisa is a comprehensive AI-powered analytics solution that allows users to analyse bank statements in real-time to check borrower credibility for quick, accurate loan approvals. Precisa is used by banks, lending institutions, and NFBCs to reduce or eliminate manual verification and analysis of bank statements using the tool’s online features. This latest feature is an […]

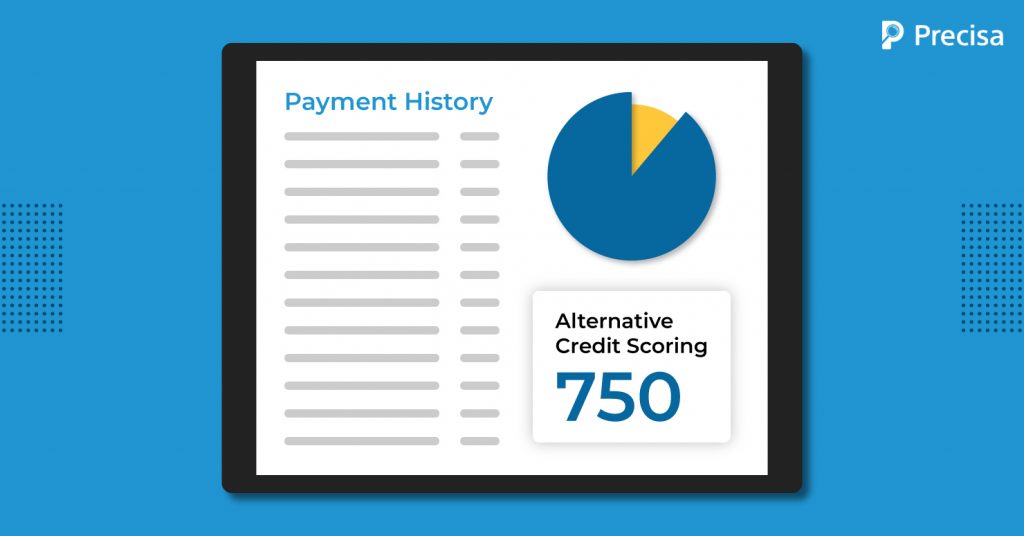

An Introduction to Alternative Credit Scoring in India

India is on the verge of astounding economic growth, with nearly 55 to 60 million MSMEs contributing to the employment and GDP of the country. However, this growth story faces a challenge from the lack of access to formal credit. Nearly 40% of the credit requirements are fulfilled through the informal channel, where interest rates […]

Things to Know About GoI’s Stimulus Package and How It’s Impacting Lending

In the wake of the second wave of the COVID outbreak, the Indian economy has been heavily impacted. Millions are jobless, businesses are bearing the brunt, and consumers are shying away from heavy expenditures, to name a few implications. Therefore, to reinvigorate the economy and prevent the downturn, the Government of India (GoI) has introduced […]

What are APIs in Bank Transactions, and How Are They Effective?

The modern and digitally advanced era has fundamentally reshaped banking operations, just as it has altered the entertainment, media, and retail industries. Similarly, the lending industry is no exception. It is on the rise and is witnessing a paradigm shift in how these operations are carried out. Open Banking is a new term that has […]

Finance Sheet Research Tools Build Bankers Faith and Responsibility

Every active company must produce scannable records of its financial performance for audit, review, and improvement purposes. Hence, financial statements are written documents that describe a company’s operations and financial performance. Government authorities, accountants, corporations, and others frequently audit financial statements to verify accuracy as well as for taxation, financing, and investment purposes. Cash flow […]