Bad loans have always been bad business for lenders, but financial institutions are increasingly tightening their purse with the pandemic exacerbating market volatility and geopolitical tensions. Although commercial loans are critical to bank asset portfolios, and the commercial lending market is set to grow at a CAGR of 13.1% over the next decade—these financial institutions […]

Why Data and Automation is the Future of SME Lending

Artificial Intelligence and Machine Learning are becoming the forefront of financial services across domains. One of the reasons behind this is an increase in lending efficiency and another being reduced manual error. However, implementing this technology can be challenging for many SMEs. In lending institutions, legacy systems and manual effort have been the norm. Breaking […]

What is Credit Rating and Why is It Crucial for Lenders?

The rising number of non-performing assets (NPAs) and fraudulent activities necessitates a closer examination of credit sanctions. According to the Reserve Bank of India’s Financial Stability Report (FSR), the gross non-performing assets (GNPAs) percentage of banks could climb to 9.8% by March 2022, up from 7.48% in March 2021, under a baseline scenario. As of […]

8 Digital Lending Use Cases in India

Digital lending in India is undergoing intense activity given the massive opportunity the sector presents. According to BCG estimates, total digital retail loans could cross the $1 trillion mark in the country by 2023. With that as the backdrop, let’s look at the use cases that drive this juggernaut. Digital Lending Models Available in India […]

Decoding the Emerging Trends in Loan Products

The financial lending industry has witnessed aggressive disruptions in recent times owing to the pandemic. Other than the increased need for end-to-end digitisation, plenty of other essential lending trends surfaced in 2020 to date. Consumer lending overall noticed a tremendous spur as people tried to keep up with the effects of the pandemic. With job […]

An Introduction to Alternative Credit Scoring in India

India is on the verge of astounding economic growth, with nearly 55 to 60 million MSMEs contributing to the employment and GDP of the country. However, this growth story faces a challenge from the lack of access to formal credit. Nearly 40% of the credit requirements are fulfilled through the informal channel, where interest rates […]

Why Bank Statement Analysis is a Key Component of Credit Appraisal

The lending business is the backbone of most of the projects in the economy. From lending to acquaintances in distress to now a full-blown industry, this practice has witnessed a significant evolution. Despite being a lucrative practice, this industry does not fail to witness multiple scams and deliberate defaults. Such defaults only make lenders wary. […]

Is Bank Statement Analysis (BSA) the Best Tool to Identify Customer Behaviour?

Bank Statement Analysis plays a crucial role in loan sanctioning. It is one of the practical ways to study the financial behaviour of the loan applicant. It gives a comprehensive picture of the customer’s economic history consisting of available balance, deposits, withdrawals, interest, service charges, penalties, overdrafts, and so on needed to vet the creditworthiness […]

Role of Customer Due Diligence in Lending

Lending is a risky affair. It always poses the threat that what if the lent money or the item(s) are not returned. It sure requires a lot of trust on the part of the lender but trusting an unknown individual or business entity can misfire and lead to grave troubles. In financial lending, banks and […]

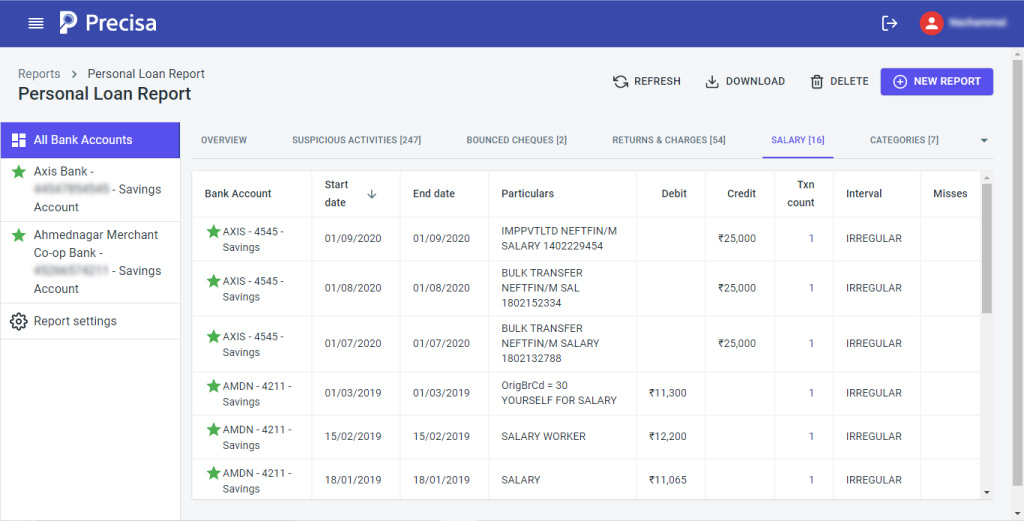

Introducing Precisa’s Salary Tab for Personal Loans Credit Evaluation

A personal loan is often a go-to resolution for individuals to meet any shortfall in financial expenses, including buying a house, vehicle, children’s education, or even in case of medical contingencies, among other things. According to reports, the amount of money borrowed in the form of personal loans has increased sharply, even in the wake […]