Fraud Indicators and Checks a Bank Statement Analyser Should Pick

A bank statement is the most basic and critical document that aids in assessing a loan applicant’s creditworthiness. Every SME or lending institution relies on bank statements to provide valuable insight into the borrower’s income and spending patterns.

The Bank Statement Analyser or BSA is an automated engine that examines bank statements by combining effective techniques with a database that provides real-time insights into the lender’s financial health.

This analytical output helps NBFCs and banks resolve their critical pain points like a physical collection of documents, slower turnaround time, high manual effort, and lower productivity, all of which lead to higher NPAs. Besides, the BSA also detects and showcases key fraud indicators that can help NBFCs make effective credit decisions.

Key Fraud Indicators Every BSA Should Detect

Below are the critical checks and fraud indicators a good bank statement analyser should pick:

1. Cheque Returns

Cheque returns attract a hefty fine and can also impact the financial integrity of the cheque issuer. Depending on the amount involved and the potential impact on the receiver, cheque returns can also incur legal actions. The BSA engine should be able to identify the details on all the cheques issued and their realisation and find out if there are any returns.

2. Charges and Penalties

The statement analyser should be able to identify all the charges or penalties attracted by the borrower like charges on cheque returns, invoices on any pre closures of deposits, charges levied due to insufficient funds on recurring payments, charges for not maintaining a minimum balance, charges on forex conversions, charges on delayed payments, etc.

3. Circular Transactions

Circular transactions are a kind of artificial transaction between the companies under a single group or a single controller. These transactions are done for multiple reasons.

The top reasons are inflating the company’s valuation to avail bigger loans, avail fake input credits to reduce tax liability, pump in black money into the system.

All the above are illegal and considered a scam by the financial regulators worldwide. The BSA engine should be able to identify such transactions, especially in the case of business borrowers.

4. Multiple Smaller Credits

If there are a large number of smaller credits from different and new sources to a single account, it is a potential money laundering practice. The BSA engine should be able to identify such patterns and highlight them for further examination.

5. Suspicious Transactions

Depending on the lending institutions’ geography, there will be a set of blacklisted entities with whom doing any fund transfer is considered illegal. BSA engine should have a real-time interface with databases on blacklist entities and should be able to identify suspicious transactions from such account statements.

6. Frequent Cash Deposits

In the current era of digital payments, frequent cash deposits can be an element of suspicion. This is true, especially in the case of retail borrowers. BSA engines should be able to identify such patterns and highlight such deposits.

7. Frequent Cash Withdrawals

Cash withdrawals are not wrong. But the amount drawn as cash against digital payments and cheque transfers in a month indicates a lot about the account holder’s spending pattern. This is especially true in the case of business borrowers.

If a business borrower does an odd number of cash withdrawals than digital payments, then this should be caught by the BSA engine and flagged for further scrutiny. This is very important, especially when the loan amount involved is significant.

8. High Valued Transactions

If there are many high-value transactions, be it credits or debits, but the month-end account balances are consistently disproportionate to those transactions, it is a potential area to dig further. BSA engine should be able to identify such scenarios.

9. Volatility in the month-end balances

If the month-end balances are consistently in the upward trend for business borrowers, it is a clear sign that the business is growing. If the month-end balance is in a downward trend or volatile, it needs further investigation before granting any big loans. BSA engine should be able to spot such trends.

10. Salary Credits on bank holidays

We know that salaries are credited only on working days. If a business borrower’s statement has entries of employee salaries debited frequently on bank holidays or a retail borrower has any salary credit entries on bank holidays, this should be caught and flagged by the BSA engine for further scrutiny.

11. Negative End of day balances

If the end of the day balance is negative for many days in a month and the month-end balance is healthy, then it is a sign of the irregularity of the borrower’s spending pattern. The BSA engine must flag this for further review.

12. Equal debits and credits

If the number of debits and credits in a period of time is equal, it is a clear sign of a scam. It means that money is being credited to the account to maintain the balance and is debited back as soon as the balance maintenance window is over. This is a clear sign of inflated income and expenses. The BSA engine should catch such behaviour and flag the transactions contributing to this.

13. Round figure tax payments

If there are many debits or credits in a round figure in a statement, it should be scrutinised further. This is especially true in the case of tax payments and other payments concerning business borrowers. By rounding off to the nearest hundreds and thousands in multiple transactions, a big amount can be hidden from the purview over a period of time. The BSA engine should be capable of flagging if the number of such transactions is significant.

14. Disproportionate Foreign Transactions

The BSA engine should be able to flag if the number of credits or debits from and into accounts in foreign banks is disproportionate to their occupation or business.

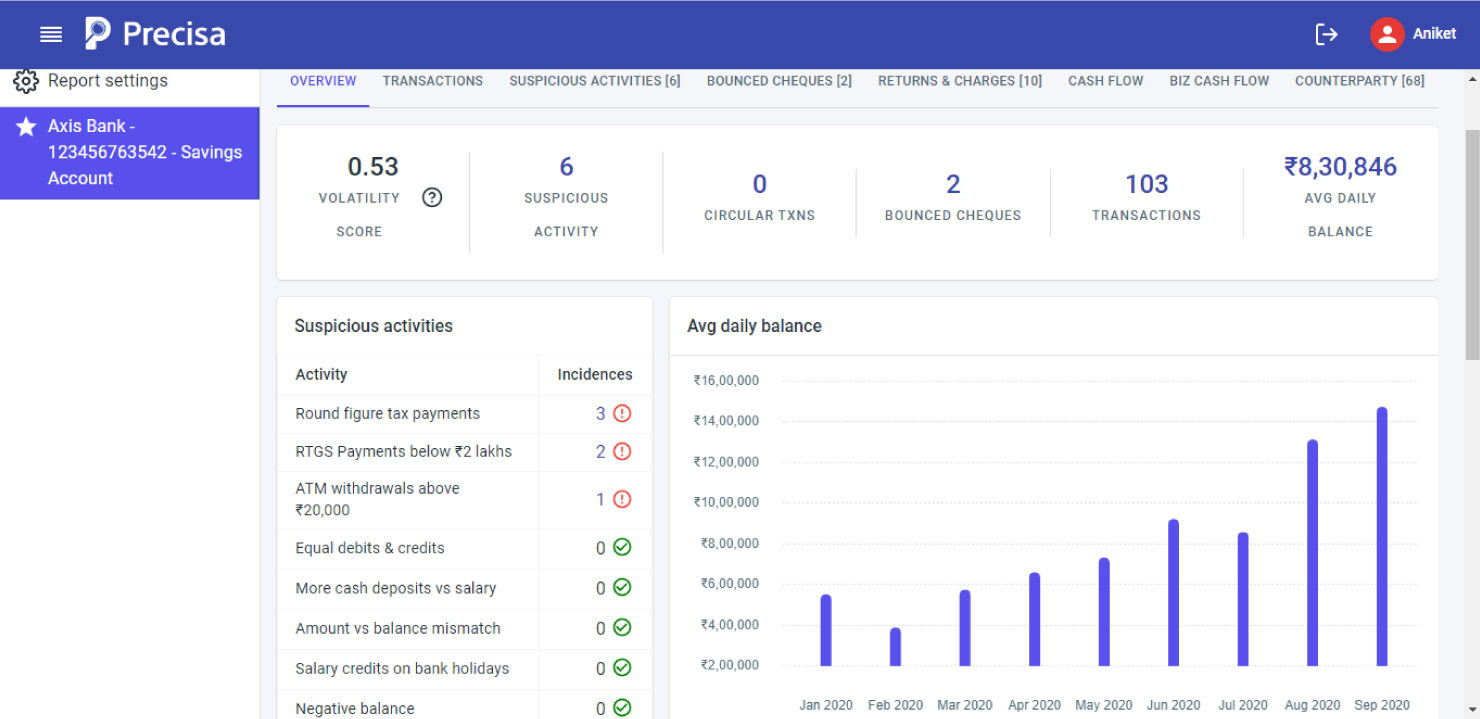

In conclusion, the BSA engine should be capable of catching the common fraudulent behaviour of and other complicated scenarios. Depending on the size of the loan involved and other transactions of the borrower, the BSA engine should have the capability to add more rules dynamically so that the report provides the exact information needed to make decisions.

Last but not the least, the BSA engine should have an intuitive reporting or dashboard kind of user interface. It should serve as a summary that gives the reviewers an easy option to click on different types of activities and go deeper into the individual transactions to take informed credit decisions.

If you are looking for a robust Bank Statement Analysis solution, that’s fast, accurate, easy to us and helps spot potential bad loan from a distance, Precisa is what you need. Precisa is simple, easy to use and you can get started for free.