How Can a Loan Management System Improve the Loan Process Flow?

Loan management is a crucial part of the lending industry, and it involves tracking, servicing, and managing loans from application to closing. The global loan servicing software market is estimated to reach $ 4812.08 million by 2028, with a CAGR of 12.19%.

The manual loan management process can be time-consuming, complex, and prone to errors, especially in large-scale lending operations. However, with the emergence of fintech-enabled modern loan management systems, the process flow has been streamlined, and lenders can now offer better services to borrowers.

This article will discuss how a loan management system can provide a more efficient loan process flow.

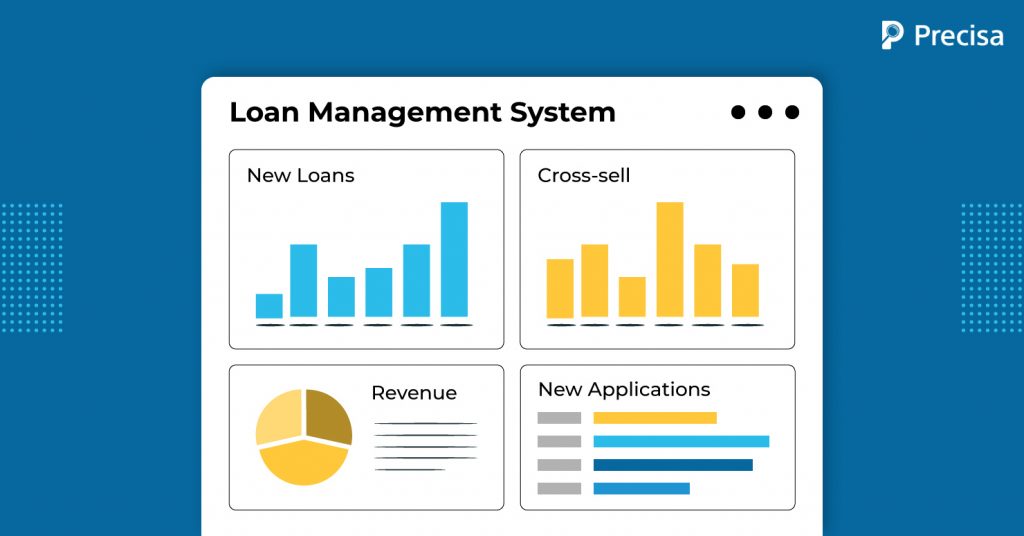

What Is a Loan Management System?

A Loan Management System (LMS) is a software platform that helps lenders automate and streamline the entire loan process, from application to disbursement and repayment. The system typically includes features such as loan origination, underwriting, servicing, collections, and reporting.

LMSs can be customised to meet the specific needs of different types of lenders, including banks, credit unions, and alternative lenders.

Benefits of a Loan Management System

The main benefits of a Loan Management System (LMS) include:

- Increased efficiency

- Reduced risk

- Improved customer experience

- By automating many of the manual processes involved in lending, LMSs can help lenders save time and reduce errors.

They can also help lenders manage credit risk by providing real-time information on loan performance. A loan management system can also make it easier for borrowers to manage their accounts and make payments online by giving them access to their loan information.

Overall, it is a powerful tool to help lenders improve their operations and better serve their customers.

How can a Loan Management System Improve the Loan Process Flow?

Loan management systems streamline the loan process flow, reduce errors, and improve customer service using software applications. Here are some ways an LMS can help:

1. Streamlined Loan Origination

One of the key benefits of a loan management system is that it can streamline the loan origination process.

With an LMS, borrowers can apply for a loan online, and the application can be processed automatically. This means that borrowers can get an answer to their loan applications quickly, and lenders can process loan applications faster.

2. Improved Loan Underwriting

Loan underwriting evaluates a borrower’s creditworthiness and ability to repay the loan. This process is critical for lenders because it helps them assess the risk of lending money.

An intuitive loan management software can help lenders improve their underwriting process by giving them access to various data sources, including credit reports, financial statements, and other information.

3. Better Loan Servicing

Loan servicing is managing a loan after it has been disbursed. This includes collecting loan payments, managing escrow accounts, and handling customer service enquiries.

A loan management system empowers lenders to improve their loan servicing process by automating routine tasks like payment processing and account management.

4. Enhanced Risk Management

Loan management systems can also help lenders handle their credit risk more effectively. By analysing data on loan performance, the solution can help lenders identify trends and patterns that may indicate potential credit problems.

This can help lenders make better lending decisions and minimise losses.

What Are the Challenges in the Loan Management Process Flow?

Some of the common challenges in the loan management process flow include the following:

Manual processes

The loan management process involves a lot of manual processes, including data entry, document verification, and loan servicing. These processes are prone to errors, delays, and inconsistency, which can affect the quality of service and increase operational costs.

Regulatory compliance

Lenders must comply with various regulatory requirements, including Know Your Customer (KYC), Anti-Money Laundering (AML), and Consumer Protection laws. Non-compliance can result in fines, legal actions, and reputational damage.

Data security

Loan management involves handling sensitive borrower data, including personal and financial information. Lenders must ensure the data is secured and protected from unauthorised access, theft, or loss.

How Can a Modern Loan Management System Help Address These Challenges?

Here are some ways loan management software can help:

Complete Automation

The loan management system automates various processes, including origination, processing, underwriting, and servicing of loans. As a result, manual errors are reduced, the process gets faster, and staff can focus on the more important stuff.

Compliance

The LMS solution has built-in compliance features that ensure lenders comply with regulatory requirements. The software can perform KYC, AML, and other compliance checks and store compliance-related data securely.

Enhanced Security

The loan management system has robust security features that protect borrower data from unauthorised access, theft, or loss. The software encrypts data, restricts access based on user roles, and enables lenders to monitor user activity.

Personalised Customer Experience

It also provides borrowers a seamless and personalised experience throughout the loan process. It also enables borrowers to apply for loans online, track their application status, and communicate with lenders. This enhances customer satisfaction and loyalty.

Who Needs Loan Management System?

A Loan Management system is helpful for any organisation providing or managing a loan portfolio. This includes banks, credit unions, microfinance institutions, peer-to-peer lenders, finance companies, and other lending organisations.

Lenders who manage their portfolios efficiently can benefit from this software, which automates and streamlines loan origination, underwriting, servicing, and collections processes.

Additionally, loan management software enables lenders and investors to manage their portfolios and loans.

Summing Up

Fintech solutions have revolutionised the loan management system and have become an essential tool for lenders wanting to remain competitive. The software helps lenders to streamline the loan process flow, reduce operational costs, and enhance customer experience.

However, lenders must choose the right loan management software to meet their needs and budget.

Precisa is a new-age fintech platform offering cutting-edge financial data to banks, insurance firms, NBFCs, and wealth management firms. Its cloud-based products help with insurance, financial planning, wealth management, and lending.

With Precisa, you can integrate Finezza LOS to manage loan origination from Enquiry to Loan Disbursement from a single integrated system.

Book a free trial to learn more about Precisa!