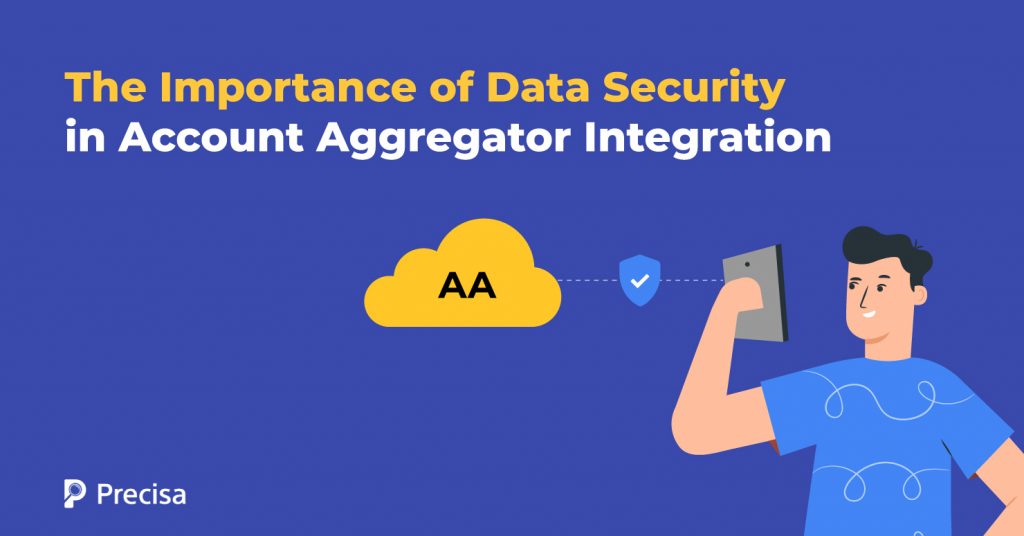

The Importance of Data Security in Account Aggregator Integration

In a digital-forward economy, borrowers have to repeatedly share extensive personal and financial data with lenders throughout their lifetime, which often poses both inconvenience and security risks.

On top of that, this sensitive information includes profile details, addresses, credit card information, bank transactions, and investment details, all of which are vulnerable to potential breaches.

With the increase in cyber-attacks, phishing, and other types of cyber crimes, customers of financial services have become more wary of sharing data. This is where secure account aggregator integration ensures that data is shared seamlessly and securely.

In this blog post, we deconstruct account aggregators and how they can be integrated into the financial ecosystem to ensure data confidentiality.

Snapshot of Account Aggregator Framework

An account aggregator is a third party that has the authority to consolidate, manage, and share a customer’s financial data with a financial services provider. In this process, data sharing is only done with the consent of the customer. This approach ensures that the customer’s data cannot be used without their knowledge.

Also, the entire process is automated, making it a seamless, convenient method for the various stakeholders who comprise the customer, the account aggregator, the Financial Information Providers (FIP), and the Financial Information User (FIU).

The Account Aggregator framework declares the following details upfront to the customer when seeking their consent for data sharing:

Key Stakeholders

- Name of the FIU, which may comprise lenders, insurance companies, wealth advisories, and other companies offering services and products

- Name of the FIPs, which comprise banks and Non-Banking Financial Companies (NBFCs), which offer provide bank statement details

- Digital signature of the Account Aggregator requesting data

Request Details

- The purpose for requesting data (lending, investing, or insurance)

- The data fields required to be shared from a financial document

- The time frame within which the data will be used by the FIU

- The time frame during which the customer’s consent is valid

- The frequency of data pulling (once or at a recurring frequency)

What is Account Aggregator Integration?

Financial services leverage multiple software to automate various processes in the financial services life cycle. For instance, lenders leverage bank statement analysis software to extract, segregate, and analyse financial data to make accurate underwriting decisions.

Account aggregation integration is the mechanism by which a third-party account aggregator solution is integrated into other software being used by a financial service provider.

Here’s an example in the context of lenders. Say a lender is using a bank statement analysis software to extract, segregate and analyse the financial data of a borrower in-depth. When the borrower applies for the loan, they must first share their financial data with the lender.

Account aggregation integration is the mechanism by which the lender integrates third-party account aggregators into their bank statement analysis software. If executed properly, the integration ensures that the borrower’s data can securely be pulled by the bank statement analysis software, without delays. It is then processed and comprehensively analysed to predict a borrower’s creditworthiness.

The Account Aggregator Integration Process

Lenders can enable account aggregator integration with the adoption of a secure, standardised Application Programming Interface (API). The API connects the lender’s bank’s ecosystem to the third-party account aggregator, allowing both to exchange data securely.

A superior API ensures that proper regulatory guidelines and encryption standards are followed. Once the integration is complete, lenders can provide their credit services to customers, with the confidence that customer data can be accessed securely, and conveniently.

Top Benefits of Account Aggregator Integration

Lenders looking to scale their business quickly without undue risks must consider account aggregator integration. This comes with a number of advantages, such as:

Secure Exchange of Data

Superior account aggregation integration ensures that customer data is securely shared with relevant stakeholders. The potential for cyber attacks and compromise of data is reduced. Thus customers can be assured that their data is kept confidential and protected from being misused by hackers and other entities.

Transparent Process

Lack of transparency in any financial service reduces customer trust in a business. The account aggregator framework ensures that data is only shared with legitimate financial businesses with the consent of the customer. Additionally, the customer has access to detailed information, which allows them to offer consent within seconds. This workflow helps increase customer trust in the financial ecosystem.

Convenience for Customers

Customers find it cumbersome and time-consuming to keep sharing data every time they apply for a loan. They need to manually consolidate all documents, and reach out to their banks for information.

However, the emergence of the account aggregator framework means that they no longer need to manually share their financial documents, and details every time they apply for a loan. They can leverage this system multiple times, with multiple stakeholders.

This approach brings convenience, and flexibility for customers, thus removing barriers from the loan application process.

Quicker Loan Turnaround

The lending process experiences a slowdown due to the lack of, or slow inflow of information. Lenders also needed to manually follow up to plug in the gaps. However, with the adoption of account aggregator integration, lenders receive data quickly and efficiently.

In turn, they can expedite the underwriting process. Thus customers can expect a quicker turnaround on their loan applications, and businesses can drive conversions.

Drive Scalability and Revenues

The slow movement of data has made it challenging for businesses to scale quickly, and efficiently without increasing risk. However, by reaping the benefits of account aggregator integration, businesses can scale up quickly, drive revenues and push for profitability.

Final Note

By closing the open data-sharing gaps through secure account aggregator integration, lenders simplify the loan application process for customers. They can also expedite turnaround time on loan applications. In turn, lenders can be in a position to boost conversions and accelerate business growth, without the risks of compromised data security.

Presica’s Bank Statement Analysis solution simplifies and speeds up the process through automation. The software provides actionable insights on a customisable dashboard, thus helping companies make informed business decisions and minimise room for errors.

Request a free demo today!