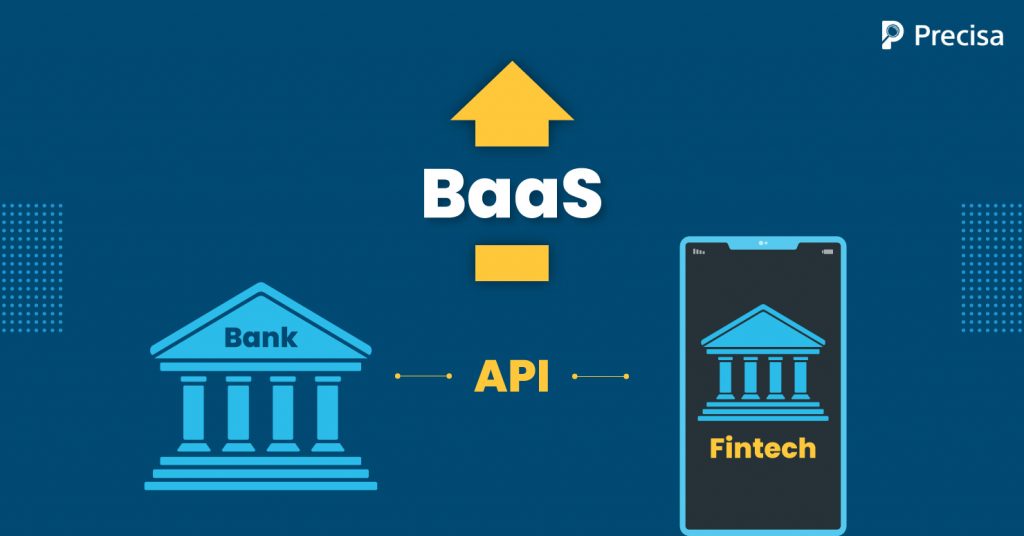

BaaS, or Banking as a Service, is part of the FinTech revolution that is gripping the world, as well as India. BaaS refers to banking services that operate entirely online. BaaS platforms offer complete end-to-end solutions digitally. Traditional banks, which have hitherto been used to doing business offline, are now experiencing a crisis of faith. […]

The Rise of Banking as a Service (BaaS) In India’s Fintech Centre

Banking as a Service (BaaS) has replaced open banking in India, and it is transforming the banking business. This may appear to be a bold statement. However, industry developments such as the rapid expansion of neobanks and the proliferation of customer-centric banking products support it. BaaS is becoming more popular as the demand for customer-centric […]

Role of User Experience Design in Fintech

The speed of digitisation in financial services had been picking up for a while, but the pandemic has accelerated it big time. Fintech-as-a-Service (FaaS) platform, growth in digital-only banks, increased usage of biometric security systems, and the rise of autonomous finance have all lately emerged. When it comes to digital transformation, Fintech, of course, is […]

A New Era for Fintech: Embedded Finance

It wasn’t long ago when Google Pay, Paytm, or UPI came into our lives and revolutionised the financial services sector and our purchasing habits. It feels incredible to effortlessly purchase goods, pay for expenses, book tickets, all in one go with just one tap/click. This seamless integration of financial services into a traditionally non-financial platform […]

How AI & ML Can Streamline Financial Compliance and Risk Mitigation

Managing risk and regulatory compliance in today’s connected and digital world is becoming increasingly complex and expensive. As a result, artificial intelligence (AI) and machine learning (ML) have gained popularity in the last decade to increase efficiency productivity and reduce costs across industries. As traditional banks compete relentlessly with new fintech companies, their legacy software […]

How Digital Credit Is Overturning Age-Old Banking Concepts

Consumer credit has seen record growth since the pandemic. Across all income brackets in the country, there has been a sustained upsurge in demand. Moreover, with the rise of the fintech ecosystem in recent years, digital credit has taken off, transforming how loans are procured and disbursed. Additionally, digital loans’ popularity is attributable to increased […]

Can Co-lending Fulfill RBI’s Aim to Connect NBFCs, HFCs, and Banks?

The pandemic has altered the cost of living for the average Indian. The Center for Monitoring Indian Economy revealed that 55% of households in India experienced a decrease in their incomes while only 3% of the households had an increase of the same. Marko Carevic, Chief Marketing Officer of Home Credit India, said that nearly […]

Decoding Budget 2022 and Its Impact on Fintechs

The economic multiplier has been set in action by Budget 2022, which focuses on quick, holistic, and inclusive economic growth. In addition, the Finance Minister has given the rural sector a strong push and raised budgetary allocations for the MSME sector—while fostering an environment favourable to the development of start-ups in the country. These projects […]

Top 4 Reasons for Cyber Resilience in the Era of Hustling Fintechs

Today businesses of all sizes have digital technology. More than 2100 fintech companies in India alone have digitised every possible consumer interface. But unfortunately, this transformation has also made them vulnerable to cyber-attacks. As per a recent ImmuniWeb survey, 98 of the top 100 global fintech startups are prone to cyber-attacks. Hence, these companies are […]

From 2017 to 2022: A Collision Between GSTR and MSMEs

We are in 2022, and India’s economy is evolving amidst a global crisis. However, to achieve the $5 trillion economy dream by 2024-2025, the country certainly needs economic recalibrations. It wasn’t long ago when the pandemic caused an unprecedented downfall for the global economy, not to mention the MSME sector. Currently, the MSME sector is […]