Gromor Finance is a lending company that provides secured and unsecured financing to unassisted enterprising entrepreneurs of India, who are otherwise excluded from the lending landscape. Through simple lending processes, Gromor aims to give them the right impetus to move forward. Now, being in the lending business, Gromor’s operations rely on analysis of bank statements […]

Account Aggregators Go Live: What It Means & the Way Ahead

Account Aggregator Framework, launched in Sept. 2021 at a virtual event, is a novel technology architecture and part of India Stack – a collection of open-source APIs by GOI. Account Aggregator (AA) is a framework that provides an overview of all your financial data like income tax returns, monthly salary, accounts statements, and other information […]

Automated Bank Account Details Extraction from Bank Statement

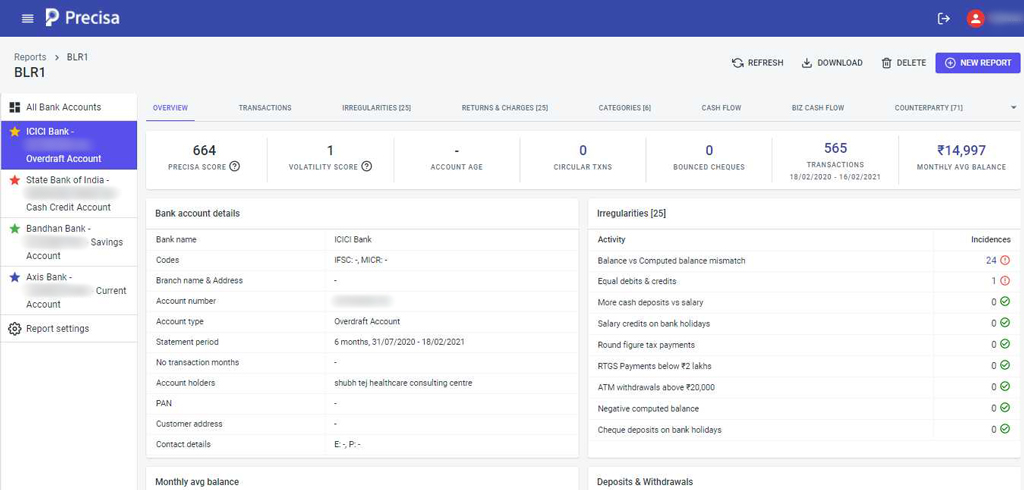

Precisa is a comprehensive AI-powered analytics solution that allows users to analyse bank statements in real-time to check borrower credibility for quick, accurate loan approvals. Precisa is used by banks, lending institutions, and NFBCs to reduce or eliminate manual verification and analysis of bank statements using the tool’s online features. This latest feature is an […]

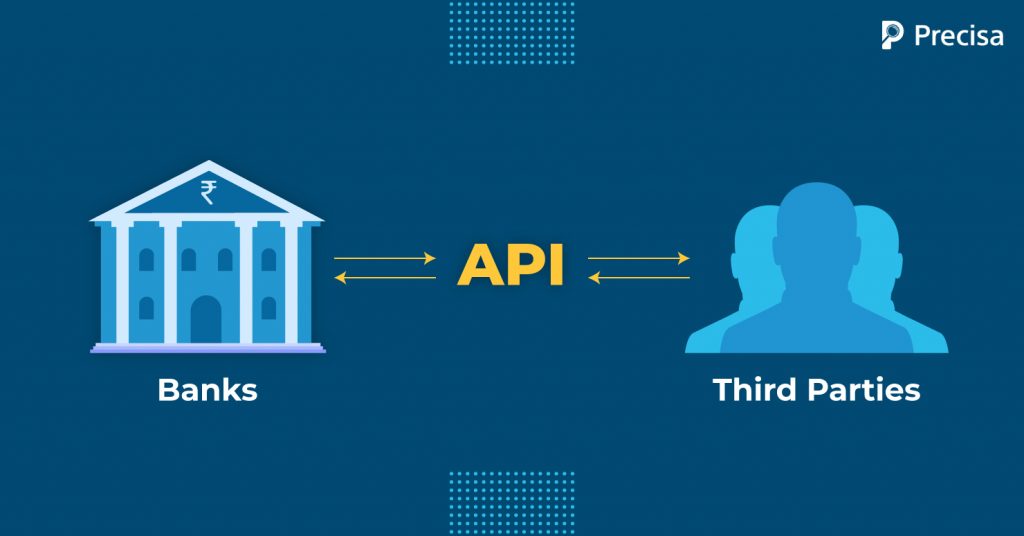

What are APIs in Bank Transactions, and How Are They Effective?

The modern and digitally advanced era has fundamentally reshaped banking operations, just as it has altered the entertainment, media, and retail industries. Similarly, the lending industry is no exception. It is on the rise and is witnessing a paradigm shift in how these operations are carried out. Open Banking is a new term that has […]

Finance Sheet Research Tools Build Bankers Faith and Responsibility

Every active company must produce scannable records of its financial performance for audit, review, and improvement purposes. Hence, financial statements are written documents that describe a company’s operations and financial performance. Government authorities, accountants, corporations, and others frequently audit financial statements to verify accuracy as well as for taxation, financing, and investment purposes. Cash flow […]

7 Major Lending Trends to Look Out For in the Wake of COVID-19

The pandemic has not only redefined public health concerns but also shuffled economies. Even when lockdowns wane, consumers struggle to regain a foothold on finances and cut back on discretionary spending. Consequently, newer lending trends in sync with time are bound to rise. Digital financial services, for instance, are in the spotlight due to the […]

How to Analyse Multiple PDF Bank Statements In Minutes?

Bank statement analysis involves parsing the bank statements to derive insightful conclusions about the borrower’s creditworthiness. But the task of processing these statements is not easy. Lenders are bogged down with processing bank statements that are often either in physical papers or PDF formats, which require further processing. Physical paper bank statements are required to […]

Why Bank Statement Analysis is a Key Component of Credit Appraisal

The lending business is the backbone of most of the projects in the economy. From lending to acquaintances in distress to now a full-blown industry, this practice has witnessed a significant evolution. Despite being a lucrative practice, this industry does not fail to witness multiple scams and deliberate defaults. Such defaults only make lenders wary. […]

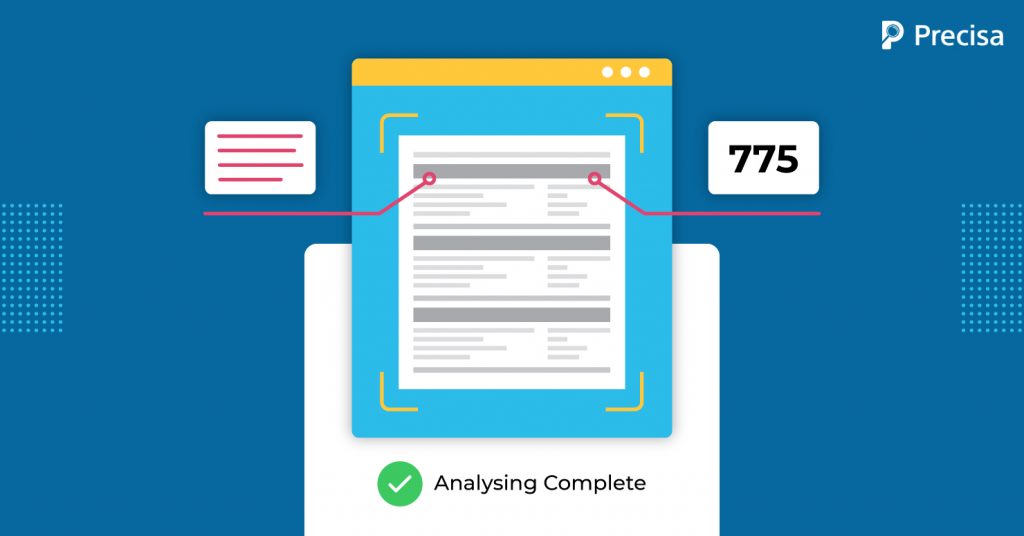

Scanned Bank Account Parsing for Easier Research

Precisa is an automated bank statement analysis platform that provides real-time bank statement analytical capabilities and reduces the need for manual intervention. Along with a host of beneficial features to make the evaluation process easy, Precisa has now integrated Scanned Document Parsing. With this new feature, lending institutions can conveniently upload bank statements in a […]

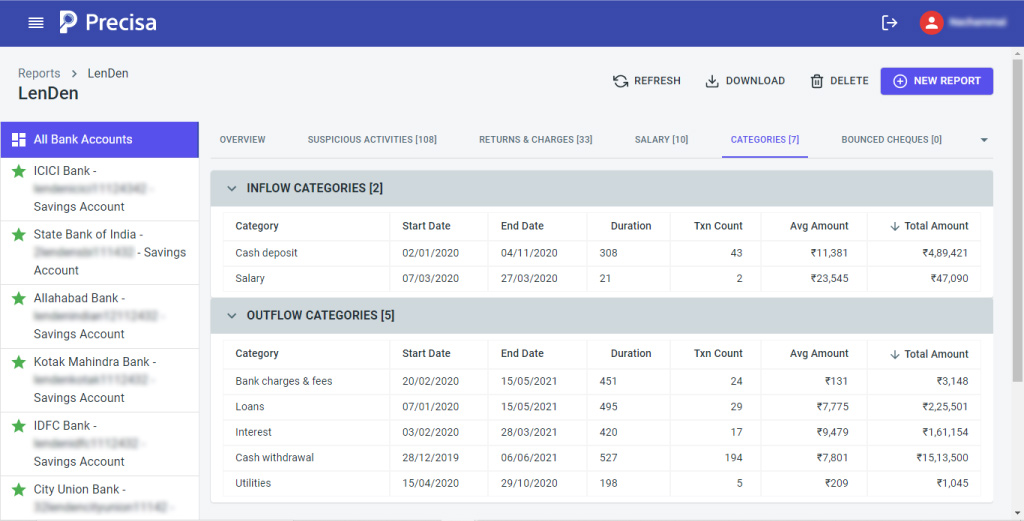

Precisa’s New Category Tab Simplifies Account Inflow and OutFlow Analysis.

Bank transactions can reveal a customer’s preferences, spending patterns, and risk factors if you can create structured features from their unstructured text. Precisa automatically detects the context or purpose of transactions in the bank statement based on its description. For example, if the transaction is ECS/BAJAJ FINANCE LI/7UPBFR809765435 Precisa will automatically detect that this payment […]