Digital lending is considered to be one of the fastest-growing verticals in the Fintech space. In India, for instance, digital lending grew from a market value of $ 9 billion in 2012 to $ 350 billion by 2023. As the scale and speed of lending grows, so does the proportion of risk. Lenders are susceptible […]

Microscopic View of a Bank Cash Flow Statement Analysis

For those new to financial analysis, distinguishing between cash flow statements and income statements can be challenging. While they may appear similar at first glance, these are distinct financial documents, each providing unique and essential insights into a company’s financial status. A cash flow statement, in conjunction with a company’s balance sheet and income statement, […]

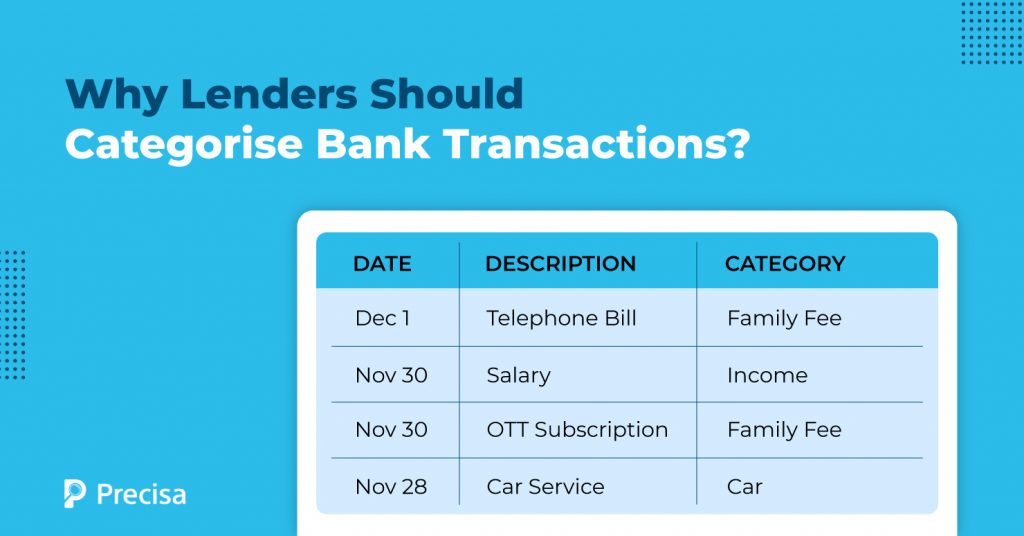

Why Lenders Should Categorise Bank Transactions (And How To Do It)

Did you know in the fiscal year 2023, India witnessed a staggering 103 billion digital transactions, amounting to over 166 trillion Indian rupees. Despite the substantial financial activity across the nation, effectively organising transactions in your bank statement remains a critical task for gaining insights into your spending patterns. Lenders always struggle to figure out […]

How to Leverage Balance Sheet Analysis to Make Informed Credit Decisions?

The balance sheet is a financial statement that provides information about a company’s assets and its sources of capital (equity and liabilities/debt). In this context, balance sheet analysis examines a company’s balance sheet to assess its financial position, liquidity, solvency, and overall financial stability. It has emerged to be a valuable tool that helps lenders, […]

Why Banks Should Apply AI-driven Customer Due Diligence

The banking industry has undergone an extensive transformation over the last few years. Rapid digitisation of banking processes and financial ecosystems is reshaping business. Many banks are reducing the number of physical branches while enabling consumers to open accounts online and carry on their transactions in no time. On the flip side of this heartwarming […]

Understanding Bank Financial Statement Analysis: Excel’s Role and Limitations

Despite the arrival of cutting-edge technologies, including artificial intelligence (AI), robotic process automation (RPA), and big analytics, Microsoft Excel still commands a firm grip over financial companies. Even today, analysts at Wall Street continue to rely on Excel sheets primarily due to their reliability, long history of use, and, sometimes, the sheer aversion to switching […]

Calculating DPD in Finance: Guide to Analysing Delinquency

As India’s lending ecosystem becomes increasingly digital and data-driven, monitoring borrower behaviour has never been more critical. With the Reserve Bank of India reporting a moderation in retail credit growth to 16.6% in June 2024—down from 21.3% the previous year—banks and NBFCs are placing greater emphasis on early risk detection and delinquency tracking to protect […]

How AI-Driven Financial Analysis Powering Efficient Due Diligence for VCs and Investors

There is a growing trend of some players in the startup world using misrepresented financials to attract an injection of capital into their ventures. For instance, a recently acquired promising startup was in the news when the acquirer discovered that the business’s financials did not tally up. The acquirer business, despite all efforts, landed in […]

Understanding the Art and Science of Cash Flow Analysis

A financially healthy company’s operations and growth often depend on effective cash management, which starts with developing a precise cash-flow forecast. Instead of a profit-and-loss statement, a cash-flow analysis balances several financial factors over a predetermined time frame. However, even a meticulous cash-flow forecast doesn’t guarantee future liquidity. To accurately predict the company’s financial inflows […]

Bank Statement Analysis: Why is it Vital for Businesses with Multiple Accounts?

Bank statement analysis is important in obtaining and analysing financial data for finance and corporate management. According to Shopify, financial statements serve as an accounting form of assessing a business’s health. Although having a single bank statement for a business can provide valuable insights, but it becomes increasingly challenging once the business has multiple accounts. […]