Banking, when it began in 13th century Italy, was personalised service. After the Industrial Revolution, when demand surged, that service became standardised and became available to the masses. The next big disruption in banking came when information technology emerged. Processes became more efficient, and profit margins fattened. Again, however, the change was inside-out, meant to […]

Here’s Why You Need to Automate Commercial Underwriting

With the advent of the Internet of Things (IoT), Artificial Intelligence (AI), chatbots, among others, you can say automation is everywhere. For example, underwriting used to be a time-consuming and lengthy process for customers who relied on traditional banking and other offline sources for loans. However, with digital platforms now making lending available, underwriting has […]

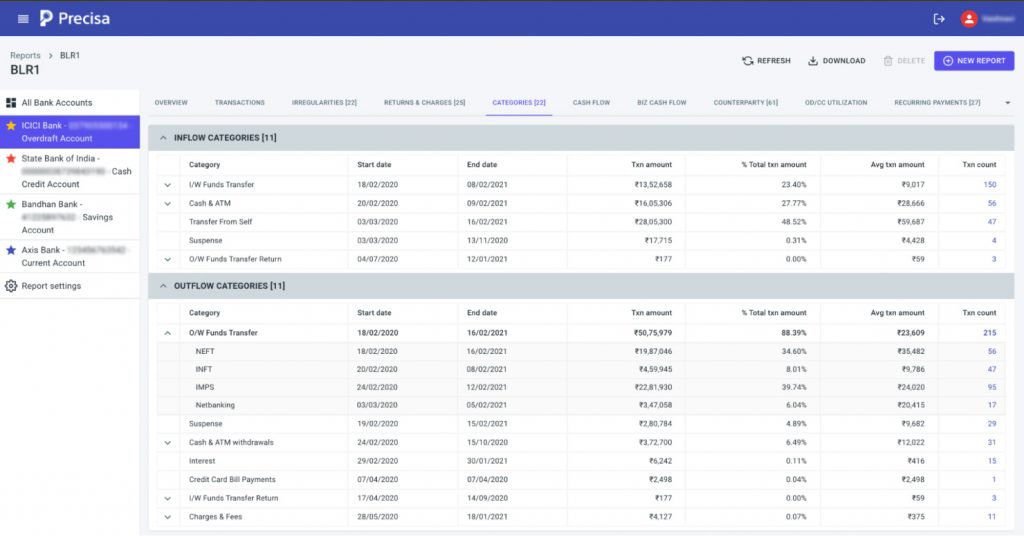

Bank Statement Analysis Simplified with Added Categories for Inflow and Outflow

Manually assessing data from the Bank Statement PDFs is a strenuous and time-consuming process. Automated Bank Statement Analysis tools on Precisa allow its users to extract the data and categorise them and facilitate more detailed segregation from the bank statements. Why Do We Need a Category View? Different public and private banks have various formats […]

How Bank Statement Analysers Are Aiding in the Search for Lower-Risk Customers

Global loan defaults have increased at a faster rate than they were before the pandemic. Direct consumers and small businesses are still struggling to pay back loans, which is unlikely to improve very soon. While retail lending accounts for 22% of total bank lending and 3.7% of total NPAs, personal loans, home loans, and vehicle […]

How Banks Can Build Customer Trust Post-COVID

The 2020 pandemic sabotaged the customer relations and trust banks had built over the years. According to a new Accenture analysis, during the COVID-19 pandemic, replacing in-person branch contacts with impersonal digital transactions via online and mobile channels has accelerated the ongoing decline of consumer trust in banks. Hence, banks need to focus on winning […]

Precisa’s Custom Bank Account Analyzer for Gromor’s Credit Assessment

Gromor Finance is a lending company that provides secured and unsecured financing to unassisted enterprising entrepreneurs of India, who are otherwise excluded from the lending landscape. Through simple lending processes, Gromor aims to give them the right impetus to move forward. Now, being in the lending business, Gromor’s operations rely on analysis of bank statements […]

Account Aggregators Go Live: What It Means & the Way Ahead

Account Aggregator Framework, launched in Sept. 2021 at a virtual event, is a novel technology architecture and part of India Stack – a collection of open-source APIs by GOI. Account Aggregator (AA) is a framework that provides an overview of all your financial data like income tax returns, monthly salary, accounts statements, and other information […]

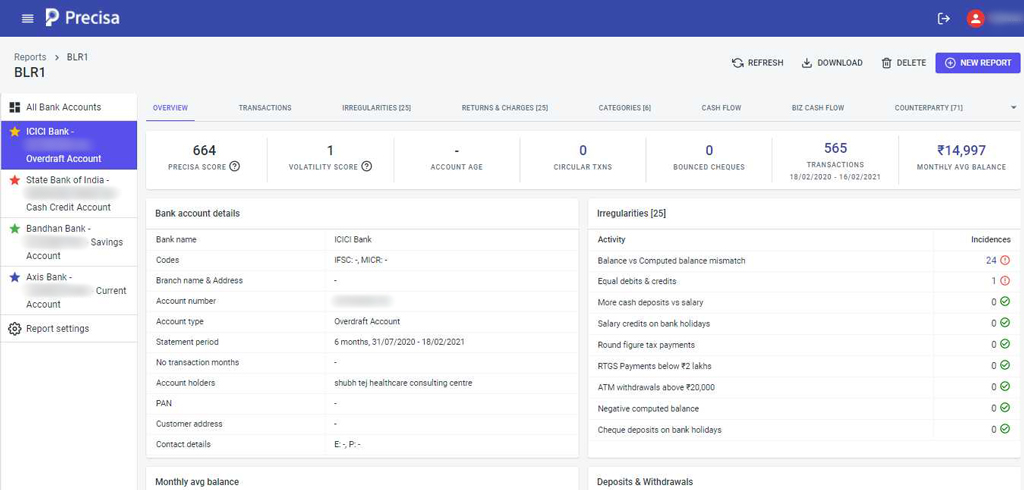

Automated Bank Account Details Extraction from Bank Statement

Precisa is a comprehensive AI-powered analytics solution that allows users to analyse bank statements in real-time to check borrower credibility for quick, accurate loan approvals. Precisa is used by banks, lending institutions, and NFBCs to reduce or eliminate manual verification and analysis of bank statements using the tool’s online features. This latest feature is an […]

Finance Sheet Research Tools Build Bankers Faith and Responsibility

Every active company must produce scannable records of its financial performance for audit, review, and improvement purposes. Hence, financial statements are written documents that describe a company’s operations and financial performance. Government authorities, accountants, corporations, and others frequently audit financial statements to verify accuracy as well as for taxation, financing, and investment purposes. Cash flow […]

7 Major Lending Trends to Look Out For in the Wake of COVID-19

The pandemic has not only redefined public health concerns but also shuffled economies. Even when lockdowns wane, consumers struggle to regain a foothold on finances and cut back on discretionary spending. Consequently, newer lending trends in sync with time are bound to rise. Digital financial services, for instance, are in the spotlight due to the […]