Big data is transforming the world, and its immense advantages have left no industry untouched. For example, big data analytics has been at the core of online banking’s revolution, becoming an integral part of the biggest banks worldwide. The digital world is generating massive volumes of data. According to a study by IBM, more than […]

How Bank Statement Analysers Are Aiding in the Search for Lower-Risk Customers

Global loan defaults have increased at a faster rate than they were before the pandemic. Direct consumers and small businesses are still struggling to pay back loans, which is unlikely to improve very soon. While retail lending accounts for 22% of total bank lending and 3.7% of total NPAs, personal loans, home loans, and vehicle […]

Can Account Aggregators (AAs) Usher in a New Age Customer-First Lending

As per expert estimates, at least 2.5 quintillion bytes (that’s an astonishing 2.5 followed by 18 zeros) of data are generated in the world over every, single, day! And a study in 2018 revealed that about 90% of that data had been created in the previous two years alone. It was also predicted that the […]

An Introduction to Alternative Credit Scoring in India

India is on the verge of astounding economic growth, with nearly 55 to 60 million MSMEs contributing to the employment and GDP of the country. However, this growth story faces a challenge from the lack of access to formal credit. Nearly 40% of the credit requirements are fulfilled through the informal channel, where interest rates […]

Why Bank Statement Analysis is a Key Component of Credit Appraisal

The lending business is the backbone of most of the projects in the economy. From lending to acquaintances in distress to now a full-blown industry, this practice has witnessed a significant evolution. Despite being a lucrative practice, this industry does not fail to witness multiple scams and deliberate defaults. Such defaults only make lenders wary. […]

Is Bank Statement Analysis (BSA) the Best Tool to Identify Customer Behaviour?

Bank Statement Analysis plays a crucial role in loan sanctioning. It is one of the practical ways to study the financial behaviour of the loan applicant. It gives a comprehensive picture of the customer’s economic history consisting of available balance, deposits, withdrawals, interest, service charges, penalties, overdrafts, and so on needed to vet the creditworthiness […]

Role of Customer Due Diligence in Lending

Lending is a risky affair. It always poses the threat that what if the lent money or the item(s) are not returned. It sure requires a lot of trust on the part of the lender but trusting an unknown individual or business entity can misfire and lead to grave troubles. In financial lending, banks and […]

Scanned Bank Account Parsing for Easier Research

Precisa is an automated bank statement analysis platform that provides real-time bank statement analytical capabilities and reduces the need for manual intervention. Along with a host of beneficial features to make the evaluation process easy, Precisa has now integrated Scanned Document Parsing. With this new feature, lending institutions can conveniently upload bank statements in a […]

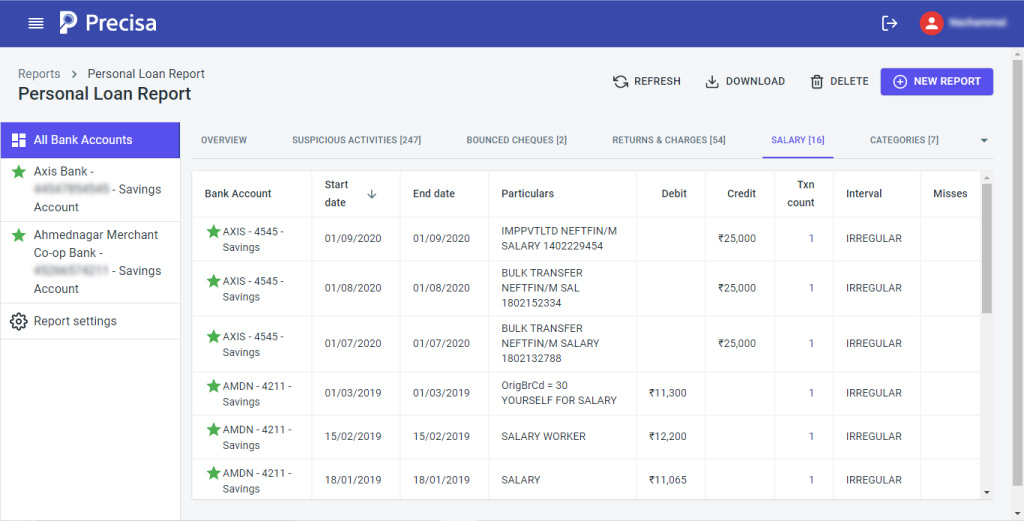

Introducing Precisa’s Salary Tab for Personal Loans Credit Evaluation

A personal loan is often a go-to resolution for individuals to meet any shortfall in financial expenses, including buying a house, vehicle, children’s education, or even in case of medical contingencies, among other things. According to reports, the amount of money borrowed in the form of personal loans has increased sharply, even in the wake […]

How to Analyse a Credit Card statement

Although India’s credit card market remains underpenetrated compared to some developed economies such as the US and China or developing economies such as Brazil, there is a higher penetration opportunity in India. According to a 2020 report published on ResearchAndMarkets, the Indian credit card industry is expected to grow at a CAGR of more than […]