The global financial sector has been in continuous flux since the last decade. The industry is evolving and expanding through innovations. Disruptive technologies that emerged served to revamp the age-old banking business models while also changing public perceptions of how banking is conducted and the services are provided. Open banking is one such technology that […]

4 Reasons NBFC Companies Are Succeeding in the Business Loan Landscape of India

Over the last few decades, non-financial banking companies (NBFCs) have become an essential part of the Indian financial system. Despite a lacklustre beginning in the 1960s, currently a significant number of business owners and retailers prefer taking loans from NBFCs over conventional banks. The arrival of NBFCs has transformed the business loan landscape in India. […]

Here’s Why NBFCs Are the Preferred Choice for Digital Lending

A report by the Reserve Bank of India (RBI) refers to the Non-Banking Financial Corporations (NBFC) as a “steady ship in choppy waters”. According to the report, the NBFC sector’s consolidated balance sheet exhibited double-digit growth in the quarter ending in December 2021. Credit disbursement also grew at a steady rate. In 2020, 60% of […]

Fintech in India | A Dive Into the Promising Fintech Sector & Its Future

India is home to 7500 + fintech startups along with 23 unicorns UPI monthly transactions reached a value of approximately $135 billion Fintech in India has 80 % adoption, compared to 64% in the rest of the world – According to the inputs by Invest India Financial technology, abbreviated as fintech, is a work in […]

Leverage Precisa’s API Integration to Credit More Loans With Less Work

Precisa’s bank statement analyser is a cloud-based analytics solution with smart automation designed for decision-makers in lending, insurance, wealth management, and personal finance. Bank statements are good indicators of a business’s or individual’s income, expenses, and spending patterns. Analysing the data from bank statements gives a reliable picture of the applicant’s current performance and future […]

Digital Lending Regulations: Bane or Boon?

The advent of technological innovations has radically changed customers’ banking habits. The widespread adoption of digital lending and payment methods following Demonetisation signalled the rise of India’s fintech-led Banking, Financial Services and Insurance (BFSI) system. Lending was the next banking activity to move to the digital space. The Indian digital lending market grew from a […]

5 Ways to Avoid Falling Prey to Illegal Digital Lending Transactions

As of September 29, 2022, India’s digital lending industry was valued at $200 Billion. The growth of this industry has created more credit opportunities for micro, small and medium enterprises (MSMEs) and other underserved segments. Several legitimate digital lending businesses have contributed to this growth. However, incidents of digital lending fraud are also on the […]

Digital Lending: Transforming the Future of Banks and SMEs

Fintech innovations are making revolutionary strides in the banking sector. They are altering the nature of banker-customer relationships, especially in lending to Small and Medium Enterprises (SMEs). Digital lending shifted the credit delivery process from the conventional lender-led mechanism to more proactive customed-based lending. This tectonic shift forced banks to reevaluate their business models and […]

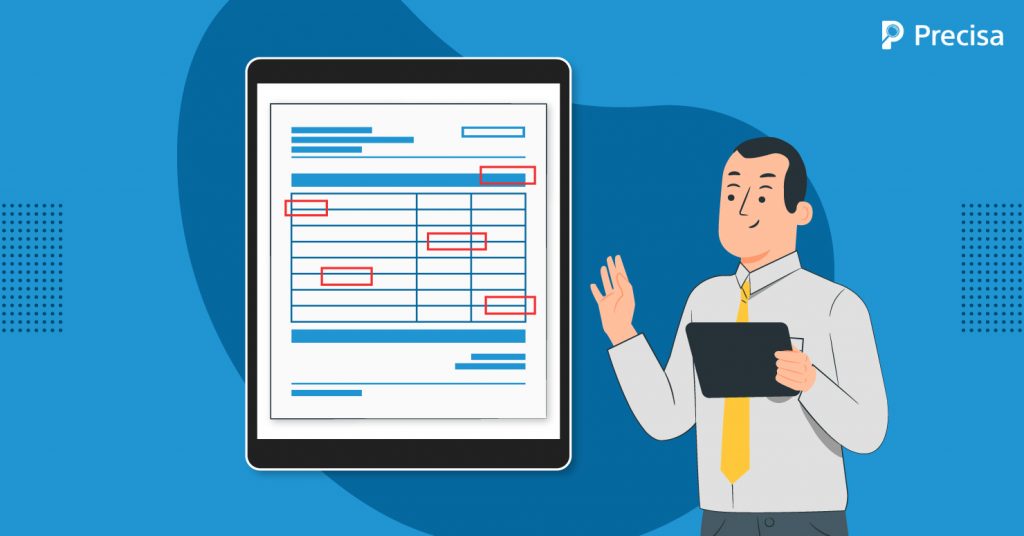

Modifications in GSTR-3B Format: A Remedy for Fake Invoicing Issues?

Implementing Goods and Service Tax (GST) in 2017 was a significant step in India’s indirect tax reforms. The goal was to establish a unified taxation system across the nation. GST amalgamated many indirect taxes to avoid double taxation. The new policy aimed to ease business by installing centralised online procedures for filing GST returns (GSTR) […]

Why Bank Statement Analysis Is Important in Lending Risk Management

In the financial year 2020-2021, the value of non-performing assets (NPAs) reported by public sector banks in India stood at INR 6 Trillion, while private sector banks reported NPAs to the tune of INR 2 Trillion. The growth of NPAs, also called “bad assets”, is a growing concern for lending institutions. According to the Reserve […]