Indi͏a is home t͏o over 14 million registered͏ GST taxpayers as of 2024, refl͏ecting the v͏ast ͏scope of businesse͏s c͏om͏plyin͏g with indirect ta͏x la͏ws. Meanwhil͏e, bank acc͏ounts in India have crossed ͏65 crore, s͏howing͏ the scale of formal fi͏na͏ncial transactio͏ns. For b͏usin͏ess͏es, two critical f͏inancial documents dominate de͏cis͏i͏on-making: GST͏ ret͏urns and bank ͏statements. GST͏ re͏turn͏s […]

4 Ways GST Analysers Play a Key Role in Credit Underwriting

Around 2.74 million Medium and Small Enterprise (MSME) loans were sanctioned in the financial year 2023-2024, a 19.3% volume and 5.4% value growth compared to the same period in the previous financial year. Additionally, microfinance loans witnessed a 26.8% growth in the defined timelines, indicating a significant rise in the demand for credit in India. […]

5 Important Metrics Loan Officers Must Consider During GSTR Analysis

India’s flourishing economy hinges on the success of its ~40 million Micro, Small, and Medium Enterprises (MSMEs), which contribute nearly 30% to the country’s GDP and about 45% to its exports. However, a few persistent roadblocks, including access to timely credit, continue to hinder MSMEs’ potential growth and scalability. For lenders, evaluating the creditworthiness of […]

How GSTR Integration Improves Loan Origination Systems

India’s demand for credit is vast, yet a significant portion of the population lacks formal credit access. For example, in the MSME sector, only 14% of businesses have access to formal credit mechanisms. The challenges in assessing borrowers’ creditworthiness are one of the main reasons for this. This stems from a lack of transparency and […]

Mitigating Risks: A Lender’s Guide to Comprehensive Loan Portfolio Assessment

As of March 2024, the gross non-performing assets (GNPAs) ratio for scheduled commercial banks stands at 2.8%, a 12-year low, exhibiting an improvement in managing default risks. Despite this, lenders must be continually wary of the impact of risky loans, as it is not just limited to the lending institutions’ profitability. It significantly undermines the […]

Red Flags in GSTR Analysis: What Lenders Should Look For When Reviewing Returns

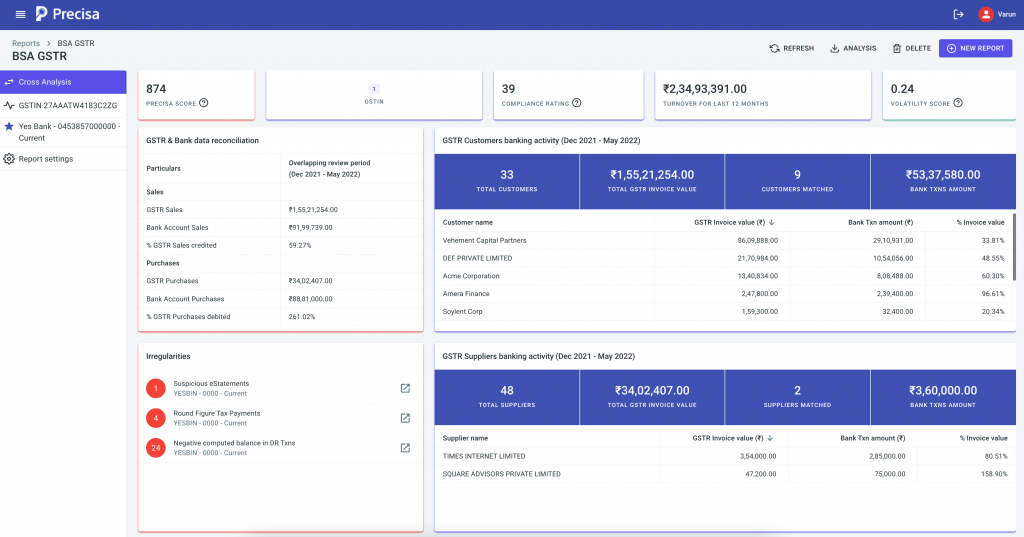

As the world becomes increasingly interconnected and digitised, each transaction and interaction generates valuable data, which, if harnessed well, can offer invaluable insights and aid decision-making. One such revolutionary use of data is the leveraging of Goods and Service Tax (GST) data by lenders to make more objective lending decisions. GSTR analysis helps lenders employ […]

How APIs for GSTR Analysis Help Assess Credit Risk

A mere decade ago, instantly delving into a borrower’s financial history would have been considered sorcery. Today, however, APIs for GSTR analysis make this a daily reality. The APIs (Application Programming Interface) effectively ensure tracking of GST compliance, pinpoint errors, and auto-generate essential reports. Imagine a cutting-edge tool that not only facilitates error detection in […]

Benefits of Leveraging Cross-analysis Tools for Profitable Cash Flow Lending

A healthy cash flow is the signifier of a thriving business. This financial status is especially beneficial for borrowers who do not own assets, which they can offer as collateral to lenders. Access to cash flow lending is enabling more underserved borrowers to get credit on the basis of business performance. For lenders, however, authenticating […]

GSTR Analysis for Fintech Startups: Why it’s Crucial for GST Review and Compliance

GSTR Analysis for Fintech Startups: Why it’s Crucial for GST Review and Compliance The supply of goods and services in India is subject to the products and Services Tax (GST). In India, the GST law was enacted in July 2017 and has since replaced several indirect taxes, including VAT, service tax, excise duty, etc. Compliance […]

Why Fintech Companies Leverage GSTR Analysis for Credit Risk Assessment

The market size of the digital lending industry in India was worth just $ 9 billion in 2012. By the end of 2023, it is projected to reach a value of $ 350 billion. Fintech companies have played a major role in the accelerated growth of digital lending, and in particular, small business financing. The […]